A 2024 Recap of the Metro Edmonton Housing Market

Edmonton's housing market has seen a banner year in 2024, with purchase and sales activity surging to record levels.

The spotlight, however, is firmly fixed on detached houses, as buyers pivot away from other property types. In contrast, condo apartments have seen a marked decline in popularity, raising questions about shifting market dynamics and the future of Edmonton's real estate sector.

The numbers tell a striking story. Detached house purchases reached 16,780 in 2024, a 9% increase from the previous peak of 15,400 in 2021. Meanwhile, condo apartment sales plummeted by over 20%, from 5,700 in 2021 to just 4,450 this year.

This decline suggests that the fervour from out-of-province buy-to-rent investors—a key driver in the condo market—may be waning.

A Seller's Market Without Price Growth

Despite robust demand and a tight market with less than three months of housing supply, prices for both houses and apartments remained flat in the latter half of 2024. Even as falling mortgage rates lured more buyers into the market, they failed to ignite upward price momentum.

This stagnation prompts an important question: what will it take for prices to rise? Analysts suggest that a combination of factors—including sustained population growth, stronger employment rates, and a balance between supply and demand—may be needed to reignite price appreciation. However, the current outlook suggests that prices may remain stagnant through 2026.

Risks Loom Large

Several risks threaten to temper Edmonton’s housing market in the coming years:

Record Construction Levels

With an unprecedented number of housing units under construction, the market could shift from a seller's market to a balanced or buyer’s market by 2026 as new inventory becomes available.

Federal Immigration Cuts

Edmonton has benefited from an influx of Canadians escaping the high costs of Toronto and Vancouver. However, recent federal cuts to immigration could slow this trend, reducing demand and putting downward pressure on prices. The policy aligns with a broader economic context, as full-time employment growth continues to decelerate across Alberta.

Employment Challenges

A slowdown in job creation is another key risk. Without steady employment growth, the pool of potential homebuyers may shrink, further dampening demand.

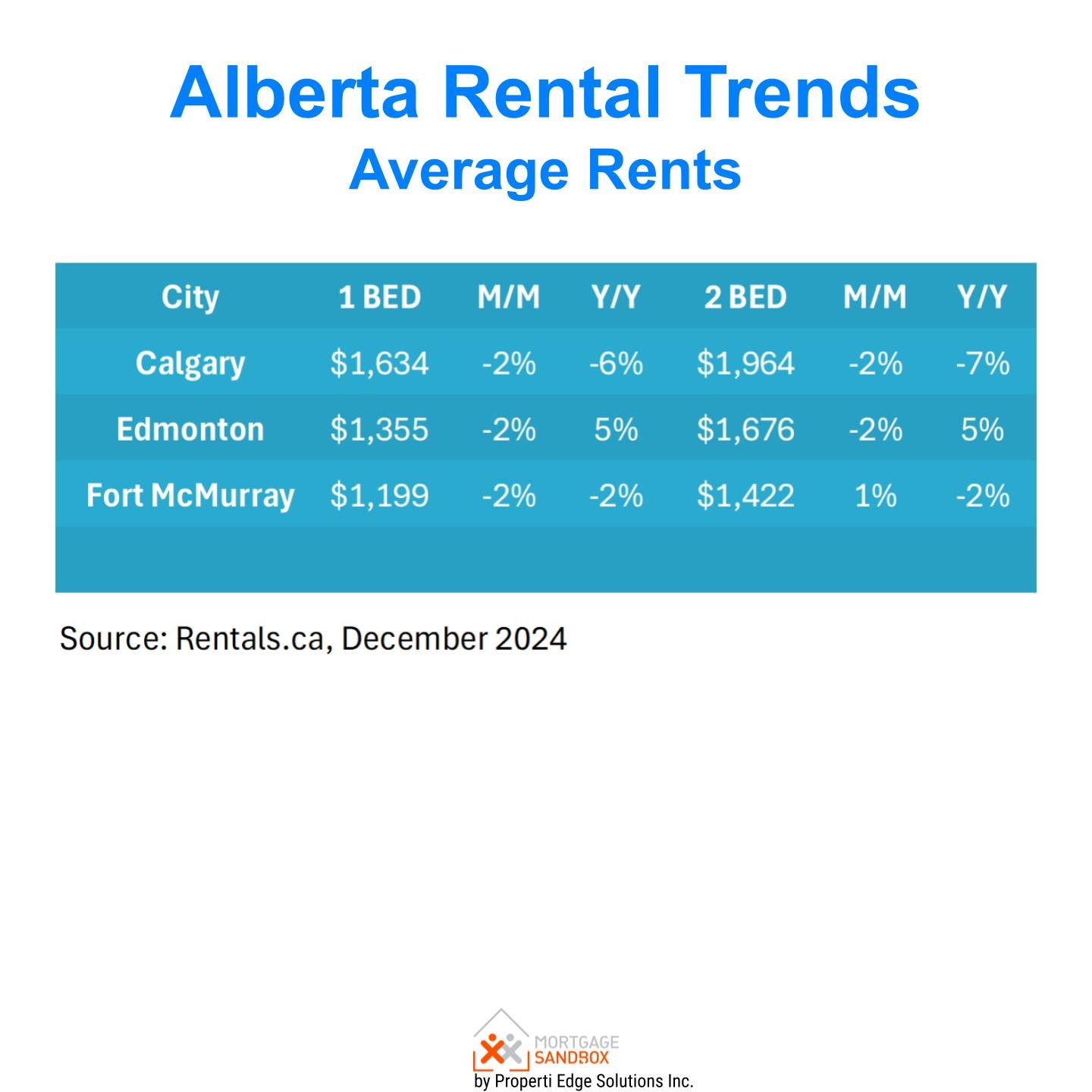

Falling Rent Rates

Rents have dipped by 2% in the past month, even before immigration cuts take full effect. This trend could discourage buy-to-rent investors, many of whom are adopting a wait-and-see approach.

Oil Price Volatility

As Alberta’s economy remains tied to the fortunes of oil, any significant drop in prices—particularly if the conflict in Ukraine is resolved—could have a cascading effect on the housing market.

Upside Opportunities

Amid the challenges, Edmonton’s housing market retains a few bright spots:

Improved Mortgage Affordability

Although mortgage rates remain high relative to the pre-2022 decade, they have dropped from their peak, offering a glimmer of hope for affordability-conscious buyers.

Competitive Pricing

Edmonton remains one of Canada’s most affordable major cities, making it an attractive option for those priced out of other urban markets. This relative affordability may help mitigate the impact of broader economic headwinds.

Looking Ahead

While Edmonton’s housing market is unlikely to see rapid price appreciation in the short term, it remains a viable option for buyers seeking affordability and stability. For investors, however, caution is warranted. The combination of flat prices, potential oversupply, and broader economic uncertainties suggests that Edmonton’s real estate market—while not without opportunities—is no longer the low-risk, high-return proposition it once was.

In the final analysis, Edmonton’s housing market embodies a curious paradox: vibrant activity set against a backdrop of price inertia. Whether the next two years bring growth or further stagnation will depend on how the city navigates the interplay of supply, demand, and broader economic forces.