2020 Okanagan Real Estate Forecast

HIGHLIGHTS

|

This article covers:

Where are Okanagan Valley prices headed?

What factors drive the price forecast?

Should investors sell?

Is this a good time to buy?

1. Where are Okanagan prices headed?

Home Price Overview

The good news (for buyers) is that prices have moderated significantly in the past year and there is less risk of being priced out of the market. People planning to sell their home will take heart in the fact that home values didn’t drop as they did in Vancouver and Calgary so they needn’t rush to sell.

In this section, we review recent price trends for houses, townhouses and condos in the Okanagan Valley and then share a forecast developed with input from a range of leading Canadian forecasters. If you would like to skip the current trends, you can scroll ahead to the 2021 Okanagan Valley Home Price Forecast.

Metro Area Detached House Prices

House prices are entering 2020 at values reached in 2018. Perhaps this is the “soft landing” that government policymakers are targeting? With more moderate price movements, we may see a return to the typical seasonal real estate cycle and price growth in the range of 1 to 3% annually – in line with income growth.

Although benchmark house prices in some parts of the the Okanagan are dropping, not all areas are seeing shrinking values. In some sub-markets, house prices have risen in the fall which runs counter to the seasonal price cycle.

Okanagan Condo Prices

Okanagan Valley condo apartment prices skyrocketed upward to May 2018 and, since then, they have plateaued. Today, the benchmark Okanagan condo is pretty affordable without help from the bank of mom and dad. A benchmark Okanagan apartment is still fairly expensive when compared to Calgary and Edmonton.

Although sales are picking up, prices are still relatively flat because there is plenty of condo supply. If supply continues to come to market, the more expensive, higher quality, and larger (i.e., 2 and 3 bedrooms) condos will drop in price and this will shift the prices downward for more modest condos.

Okanagan Valley Townhouse Prices

Still a challenge for first-time homebuyers

Although Okanagan home prices have moderated they are still not very affordable. A first-time homebuyer household earning $71,000 (the median Metro Kelowna household before-tax income) can only get a $230,000 mortgage. To buy a benchmark priced $360,000 condo, a first-time homebuyer needs to save $130,000 cash for a down payment or receive a very generous gift from mom and dad. For most people, that’s just not on the cards.

At Mortgage Sandbox, we would like to see developers building more 4 and 5 bedroom condos. Not everyone can afford to put their family in a house, and for many parents work-related travel makes it difficult to stay on top of basic upkeep (i.e., mowing lawns, clearing eaves, shovelling sidewalks).

What about the rest of BC?

Read the Vancouver Real Estate Forecast and Victoria Real Estate Forecast.

2021 Okanagan Valley House Price Forecast

The regional performance also hides some variation. For example, in 2018 a benchmark North Okanagan House gained 8% in value whereas the South only gained 3%. Over the past 3 years a Vernon-North Okanagan house would have gained 23% whereas a Kelowna-Central Okanagan house only rose 15% in the same timeframe. Most striking is a 17% drop in Central Okanagan condo prices from their peak in February 2019. This is the difficulty with regional forecasts…real estate is local.

For 2020, we expect the Okanagan Valley to experience seasonal price variations that are reflective of a more balanced market. The average of the forecasts used in our analysis predicts a modest rise of 2% each of the next two years. CMHC provides a range and their best-case scenario results in a price rise of 7% in 2020 but their pessimistic scenario sees prices drop 3%. There is still a pile of risks that could derail a price recovery and 2020 is unlikely to be a return to the booming real estate prices of the 2010s.

We expect high-end areas and luxury properties to underperform in 2020.

At Mortgage Sandbox, we provide a price range rather than attempting a single prediction because there are many risks in real estate that can impact prices. Risks are events that may or may not happen so as a result, we review a variety of forecasts from leading lenders and real estate firms and we present the most optimistic forecast, the most pessimistic forecast, and the average forecast. Want to learn more about real estate risk? We’ve written a comprehensive report that explains the level of risk in the Canadian real estate market.

2. What factors drive the price forecast?

Mortgage Sandbox 5 Factor Framework

At the highest level, supply and demand set house prices and all other factors simply drive supply or demand. At Mortgage Sandbox, we have created a five-factor framework for gathering information and performing our market analysis. The five key factors are affordability, capital flows, government policy, supply, and popular sentiment. Below we will summarize how the five factors result in the current forecast.

Affordability

Affordability is a function of:

Home Prices: The current market value of the desired home.

Savings-Equity: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: This is driven by income levels (i.e., how much money you can put toward mortgage payments) and interest rates (how big are the mortgage payments).

Increased affordability raises buyer purchasing capacity and puts upward pressure on prices while dropping affordability has the opposite effect.

How has affordability changed lately?

Home prices: From the peak, prices have dropped 1 to 17% depending on where you’re looking and what type of home you want. Lower prices improve affordability but add upward pressure on prices. However, given that prices are still very high, the current price drops aren’t making homes that much more affordable.

Savings-Equity: With rents rising faster than incomes, first-time buyers will struggle to come up with down payments and since homes prices have dropped most homeowners will have a little less home equity going in 2020 than they did in 2018.

Financing: Median incomes have not changed materially but mortgage qualifying interest rates dropped about 9% since 2018. Most forecasts predict mortgage qualifying rates will rise in 2020. Lower interest rates are a major factor driving home prices.

Over the course of 2019, affordability has improved which will add some fuel to home prices coming into 2020. Prices are still beyond the reach of a median Metro Kelowna household with an income of $71,000 (before taxes) and in 2020 mortgage qualifying interest rates are expected to rise, so we expect affordability to suffer toward the end of 2020 and this would put downward pressure on prices.

Capital Flows

These represent short-term investment, long-term investment, and recreational demand (i.e., not occupied full-time by the owner). Here is where foreign capital, real estate flippers, and dark money come into play. It also includes short-term rentals, long-term rentals, and recreational property purchases.

Capital inflows raise demand and put upward pressure on prices while capital outflows have the opposite effect. If capital sits invested in real estate nothing is bought or sold, it has no effect on the direction of prices.

Foreign capital inflows are believed to be dropping and with good reason. In 2018, in a move copied by Singapore, the B.C. foreign buyer property purchase tax was raised from 15% to 20% and extended from Metro Vancouver to the Fraser Valley, Metro Victoria, Nanaimo, and, most importantly the Central Okanagan Regional Districts. From the end of 2019 onwards, the annual B.C. speculation and vacancy tax rate will rise to 2% for foreign owners and satellite families. Finally, since some foreign buyers were circumventing the tax using Canadian shell companies, the BC government will finally go live with its corporate beneficial ownership registry in May of 2020.

The Speculation and Vacancy Taxes also impacts Canadian citizens or permanent residents who are owners of recreational properties who do not pay taxes in British Columbia.

The level of home flipping activity also declined dramatically in 2019 because it’s difficult to profitably flip homes with quick renovations when the value of the land value is dropping. The chart below is from Metro Vancouver because it’s difficult to find an equivalent analysis for the Okanagan.

As it relates to our analysis, we expect domestic interest in rental income properties is unchanged.

As well, we see no evidence of a diminished role for dark money in local real estate. It is estimated $5 billion was laundered through B.C. real estate in 2018 and approximately three percent of straw buyers were students, homemakers, or unemployed. An eye-opening report by Royal LePage says that 1 out of 10 homes purchased in B.C. are bought by Canadian residents on student visas. Students buy twice as many homes as permanent resident couples with no children. It would appear that the parents of students are using their children to evade the Foreign Buyer Tax.

The net effect of all the recent changes will be to reduce inflows of capital toward residential real estate and this will put downward pressure on home prices.

Government Policy

There has been a lot of policy aimed at housing in recent years but we are mostly concerned with any recent changes that impact the real estate market. Changes made in 2018 and earlier are pretty much already “baked-in”.

In September 2019, the federal liberals created the First-Time Home Buyer Equity Incentive to help people purchase their first home. Under the program, the government offers to put in equity worth 5% or 10% of the home’s purchase price. It is difficult to qualify and it has a lot of strings attached so we expect it will have little effect in the Okanagan market.

At the end of 2019, the annual Speculation and Vacancy Tax rate on foreigners quadrupled from 0.5% to 2.0%

BC’s Corporate Beneficial Ownership Registry comes into effect in May of 2020.

The stress test implemented in 2018 effectively reduces the amount homebuyers can borrow by 20% and its short term impact has been fully absorbed in home prices. However, we do believe it may have a long term impact affecting the supply of active listings. First-time homebuyers impacted by the test can simply buy a cheaper home and, luckily for them, home prices have dropped. But first-time homeowners who bought before 2018 may be in a bind. If they try to upgrade to a larger home they will qualify for 20%-30% less mortgage that they qualified for previously because interest rates have risen and there is a stress test. So these people who might have graduated from their starter home to something larger are forced to sit tight and pay down their mortgage. Across Canada, fewer people are choosing to sell their homes than in previous years and it is possible that the federal stress test is the root cause.

Up until now, the desired effect of the policies is to reduce unnecessary demand until more supply can come to the market. If prices fail to moderate, then we should expect more government policy interventions and more price uncertainty.

Supply

Supply comes from two sources.

Existing sales: Homes owned by individuals who sell them to upgrade, because they are moving for work, or some other reason. This is the primary source of detached single-family houses since very few new houses are being built in the Okanagan Valley.

Pre-Sales and Construction Completions: Usually, up to 70% of new homes are sold via pre-sales before the construction is completed. These are predominantly apartments and townhomes. Data on pre-sales is private and more difficult to find whereas home completions are reported by the government.

Rising supply releases the upward pressure on prices caused by demand.

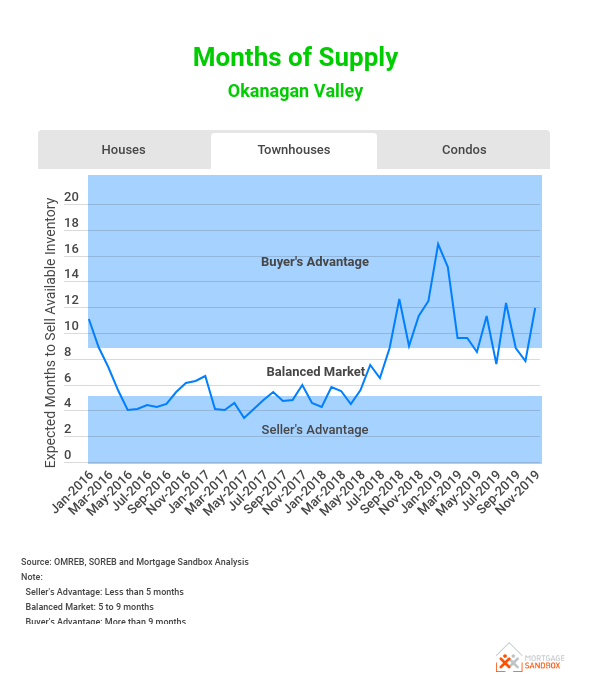

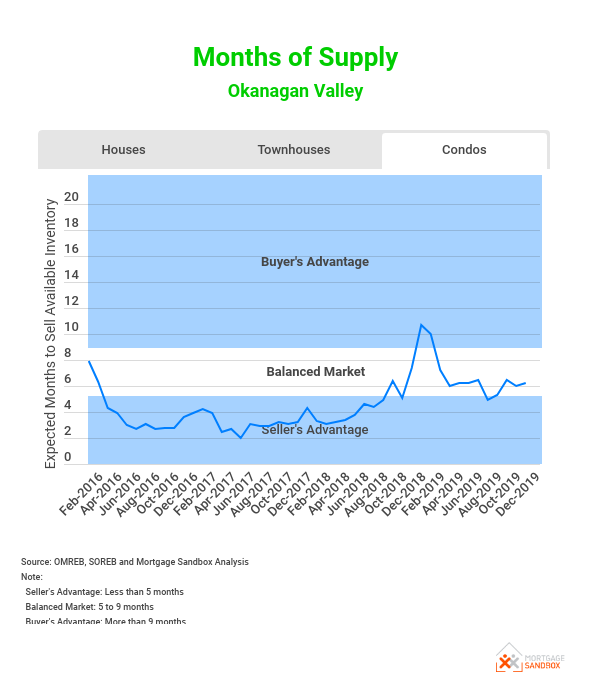

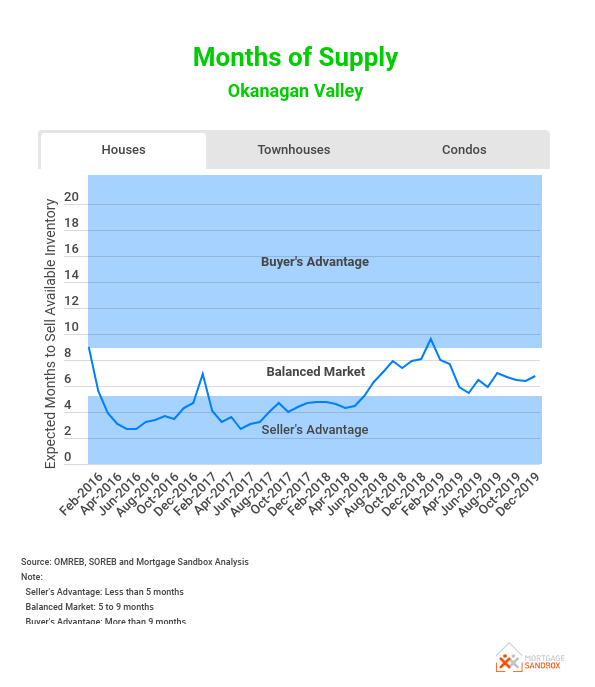

Months of Supply of Existing Homes

In recent months, sales have increased to healthier levels but haven’t broken any records. The true driver of price stability has been improved supply. The ratio between purchases and active listings is trending toward a balanced market and that means price growth should be flat in the near-term. This means buyers and sellers negotiate can both negotiate on an even footing. Sellers will not be offering much in the way discounts and incentives, nor will there be bidding wars or no-subject offers. Things are getting a little less stressful for buyers.

Baby Boomers Downsizing?

In 2020, 45% of baby boomers will be aged 65 and over and, according to a recent survey, 26 percent of B.C. Boomers who own a home had most of their retirement savings tied up in real estate - the highest rate of any province. A recent report on all Canadian Boomers from RBC says, “Over the coming decade, we expect baby boomers to ‘release’ half a million homes they currently own—the result of the natural shrinking of their ranks, and their shift to rental forms of housing, such as seniors’ homes, for health or lifestyle reasons.”

As baby boomers begin downsizing and list their half-a-million-dollar homes for sale they will add supply in what is considered the Okanagan luxury market. If not enough Gen-X and millennial buyers can be found for these expensive homes, there is a risk that this may depress prices at the top of the market, which will then compress prices for townhomes and condo apartments.

In the near-term supply is balanced, but in the medium-term, there are risks of higher than expected supply.

Mortgage Delinquencies and Foreclosures

The most recent data indicates that more Canadians are missing their monthly payments and job growth has been healthy. Some economists have been warning of a recession and even without a recession, it appears more Canadians are over-extending themselves. Even though delinquency rates are relatively low, it is surprising that the increases in mortgage delinquencies are led by Ontario and British Columbia, and not Alberta.

According to Equifax, the credit bureau company:

“Mortgage delinquencies have also been on the rise. The 90-day-plus delinquency rate for mortgages rose to 0.18 percent, an increase of 6.7 percent from last year. Ontario (17.6%) led the increases in mortgage delinquency followed by British Columbia (15.6%) and Alberta (14.8%). The most recent rise in mortgage delinquency extends the streak to four straight quarters.”

A recent survey by MNP reported a staggering number of Canadians are stretched to their limits:

“Over 30 per cent of Canadians say they’re concerned that rising interest rates could push them close to bankruptcy, according to a nationwide survey conducted by Ipsos on behalf of MNP, one of the largest personal insolvency practices in the country.”

Pre-sales and Completions

New Construction: There were a record number of new homes completed in 2019 but housing starts have been slower than in the past two years. As people move out of their rentals or sell their current home to move into these brand new homes, this new supply should alleviate some of the pressure in the market. However new supply looks like it will contract in 2020 and 2021 putting upward pressure on prices.

A key consideration - condo units completing in late 2021 were sold at peak prices before the recent price correction. These “peak price” condos will be very difficult to flip at a profit and buyers taking possession will have difficulty obtaining mortgages when if the market value turns out to be lower than the purchase price. As a result, peak priced condos may be re-released to the market but with tight sales timelines.

Pre-sales: Pre-sales, which are purchases of brand-new homes from developers, have trended down substantially since 2018. Since developers need to sell at least 70% of a project to secure financing and begin construction, they are trying to entice buyers with price discounts, move-in allowances, and cool amenities. We recently received a pre-sale ad that offered homes for sale with only a 5% deposit when normally a 20% deposit is required for pre-sales!

Data on Okanagan pre-sales is hard to find but since the Okanagan and Vancouver markets share common characteristics, the chart below gives you an idea of what is likely happening in the Okanagan Valley.

Popular Sentiment

Buyers who were sitting on the sidelines are now springing into action but sellers, who remember when their home worth 5% more, may be reluctant to sell. At its core, seller reluctance is what is holding prices up. If listings rise, then the market will tilt in favour of buyers and prices will drop. There’s no way of predicting seller sentiment but, as witnessed in the past two years, sentiment can shift quickly.

3. Should Investors Sell?

From a seller’s perspective, there are more changes in the market that influence prices downward so now may be a better time to sell than in two years and the seasonal real estate cycle usually favours sellers in the first half of the year.

Sellers should always consult a mortgage broker early to prioritize flexible loan conditions and reduce the risk of mortgage cancellation penalties. Find out more about the benefits of a mortgage broker.

4. Is this a good time to buy?

With lower prices, homebuyers who waited from 2018 to 2020 have been rewarded. With prices now stabilizing, 2020 definitely appears to be a favourable time to buy. Looking forward to 2021, prices may be higher or lower but they are unlikely to rise dramatically so buyers shouldn’t feel the need to rush to an offer. Also, keep in mind that the seasonal real estate cycle usually favours buyers in late summer.

If you are thinking of buying just be sure to drive a hard bargain and cover your bases with smart and educated decisions. Don’t bite off more than you can chew.

Buying a home is a big decision, so check out Mortgage Sandbox’s Canadian Homebuyer Guide so we can walk you through the end-to-end process and get you ready to buy your new home!

Here are some recent headlines you might be interested in:

Kelowna's downtown core reaching new heights (Vancouver Sun)

Kelowna’s vacancy rate climbs to 3% (KelownaNow)

Okanagan assessment value increases do not correlate with higher taxes, says Municipality (Kelowna Capital News)

Houses in Penticton dip in value in 2019 (The Daily Courier)

Kelowna, Vernon see steep dip in housing prices in first six months of 2019 (Kelowna Capital News)

Assessing whether 2020 will bring a Canadian property tumble (CBC)

Should Canada ban non-residents from buying homes? (TheStar)

Canada’s Risky Housing Market Has Traded Places With The U.S., IMF Says (HuffPost)

Like this report? Like us on Facebook.