Condo prices continue to rise while Detached home prices are flat

In early April, we analysed real estate data for the City of Vancouver to identify the medium-term trends in the market. At that time, we came to three important conclusions:

1. Condo apartment prices still rising.

2. Detached home sales are softening.

3. Practices within real estate are misleading people to think the market is still booming.

In this article, I am going to analyze both the apartment and housing market, and provide further insight to predict what might occur in coming months and why. Click here to read more about practices we would like to see changed in the Real Estate industry.

Condo Apartment Market

Key takeaways from the April analysis that were derived and concluded was that the prices were rising and the supply shortage was deteriorating. Alas, there is good news. In April and May, inventory increased to 27% and 26% respectively leading to the highest total Condo Apartment inventory since November 2015 (Though the number came close in October 2016).

Rising inventory should in theory put downward pressure on prices while competing sellers will increase buyer power and provide more choice, and therefore increase sales. However, we are yet to see this in the market.

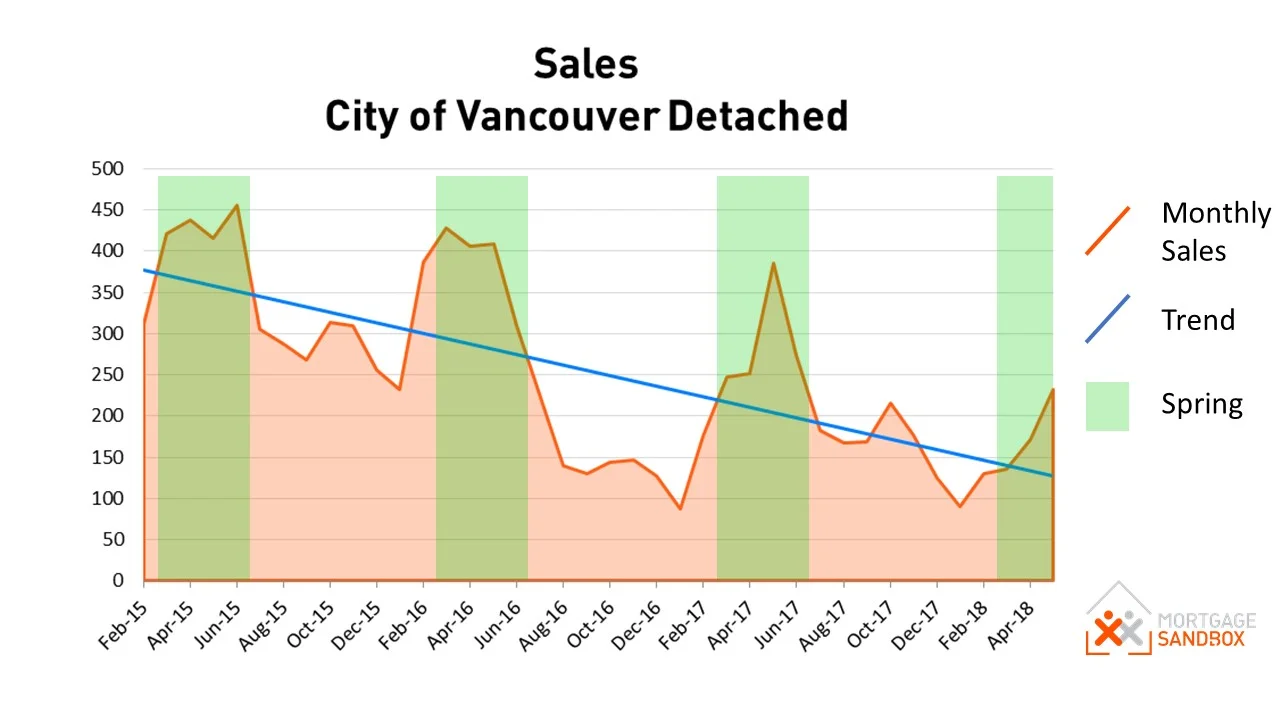

In the chart below spring sales (The green intervals) tend to cause a spike, generally because spring is the most popular time to buy. However, though sales rose slightly in May we have not seen the significant spring sales jump and we believe this is because prices have continued to climb.

In April, too few homes for sale was cited as an explanation for decreased sales but, with inventory being at a 30-month high, this argument no longer holds. Here are some key factors that help explain the current state of the market:

- Taxes, high home prices, and new data sharing policies with China has stifled demand from foreign speculators.

- Rising mortgage interest rates are reducing the amount of money people can borrow to support a home purchase.

- New mortgage stress tests introduced in January have reduced home buying budgets by ~20%.

- Uncertainty of the medium-term future of the market may have led buyers to take a “wait-and-see” approach.

Even with advanced data analytics, it’s near impossible to pin-point the precise impact of each of these factors. Considering that all these factors should be forcing prices down it’s strange that prices continue to rise. One explanation for this is that prices tend to move up swiftly with buyer emotion, however prices are said to be “sticky” on the way down because sellers are hesitant to lower their expectations. In layman’s terms, home buyers understand paying the market price for a home even when prices rise, but sellers anchor their price expectations at the market peak and are obviously far more reluctant to accept an offer that is below the peak even if that is the current market rate.

Regarding the Vancouver Condo market, Vancouverites have watched prices soar over the past decade and therefore only the most desperate sellers would even consider accepting a reduced-price offer. However, if the market factors discussed remain constant then it is reasonable to expect price rises to slow and sales to gradually increase. These conditions could bring the Condo market from a strong “sellers’ market” to a “balanced market”, one in which sellers and buyers have equal negotiating power. In a balanced market, prices tend to rise very slowly (closer to 2% annually).

Detached Home Market

Spring is typically the best time of year for home sales and - unlike the Condo Apartment Market, the Detached Home Market has delivered the rise in Spring sales we expect. The theory behind seasonal run-up in sales is believed to be because houses look more appealing in fair weather with green gardens, and Spring sales complete in the Summer so families can move when kids are out of school both points are more relevant to the detached homes which are most appealing to families.

The current trend for detached home sales is still declining year-on-year. Even considering the dramatic 40% drop in year-over-year May sales, sales volume will surely flatten before hitting zero. This year and last year’s January troughs saw monthly sales dip below 100. It’s reasonable to expect that the market won’t near 100 again until the end of the year.

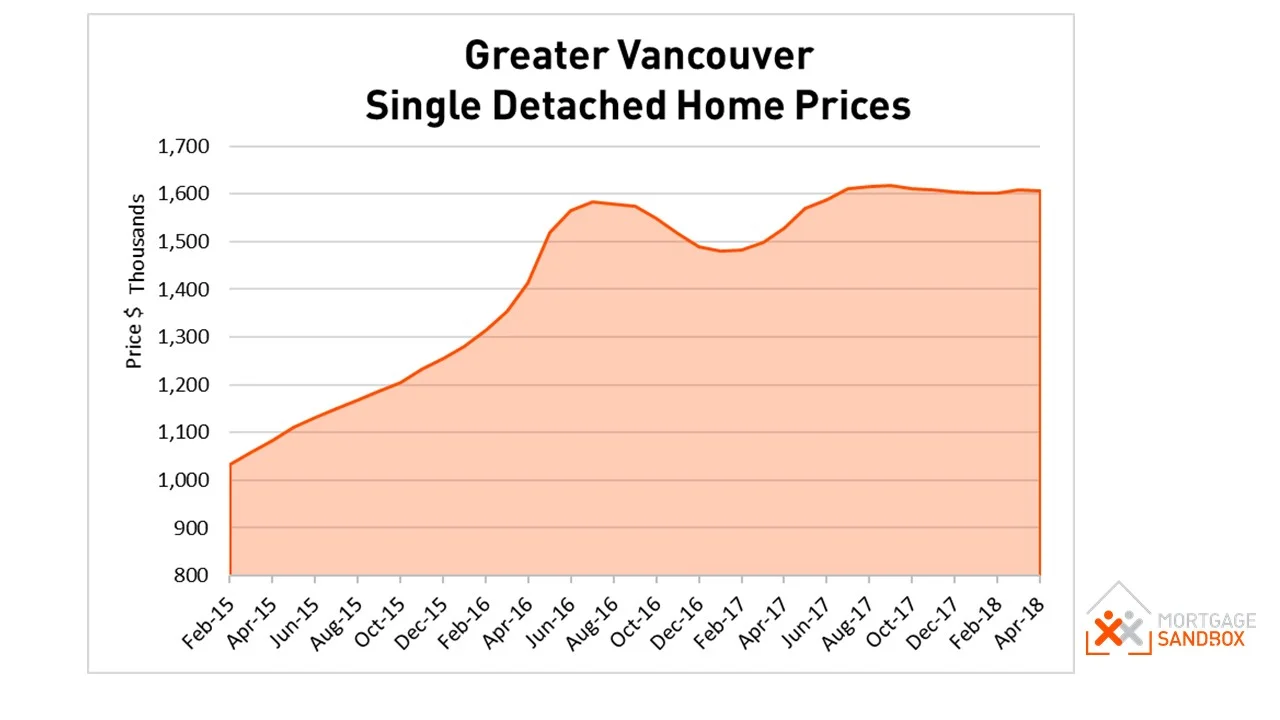

Below, you can see that detached home prices have been flat since August of 2017. The persistent slump in sales combined with the continued rise in supply are the driving forces behind stagnant detached home prices. Though buyers have more choice than ever, unaffordable high prices are preventing most buyers from making a purchase. Prices are unlikely to decline significantly in the near-term because patient sellers will wait for the market to pick up rather than reduce prices. However, if sellers lose patience, prices could slide.

Conclusion

No need to “look at the tea leaves”. The current market is very unique and shows many of the signs that precede a market correction. Prices are at record highs, buying budgets have dropped over 20%, and there haven’t been so many homes for sale in a very long time, and it appears that speculative buyers have left for the exits.

Perhaps it isn’t surprising that the remaining buyers are taking a “wait-and-see” approach to the market.

All Data provided by the Greater Vancouver Real Estate Board, June 2018