Why are there Real Estate Risk Assessments?

A home is a place to live and an investment. If you would not buy a home unless you are confident it will go up in value over the next 5 to 10 years, then you should read the reports from CMHC and Royal Bank in more detail otherwise this summary should suffice.

Report Findings

RBC recently released a Housing Health Check. It is very similar to a Housing Market Assessment released by CMHC but RBC's dashboard is more detailed in some ways. The fact that RBC, the largest Canadian mortgage lender, and CMHC, the largest provider of mortgage default insurance, have created these early warning systems should tell you that there is real risk in the real estate market and they are most concerned about Vancouver and Toronto.

Property Developers know this, which is why they often diversify their projects across different cities. It’s also one reason that they pre-sell homes and lock in the sale-price at a level where they are comfortable they will cover their costs. If there were no risk of prices dropping they would never pre-sell, instead they would wait until the building was complete and sell the units at a higher price.

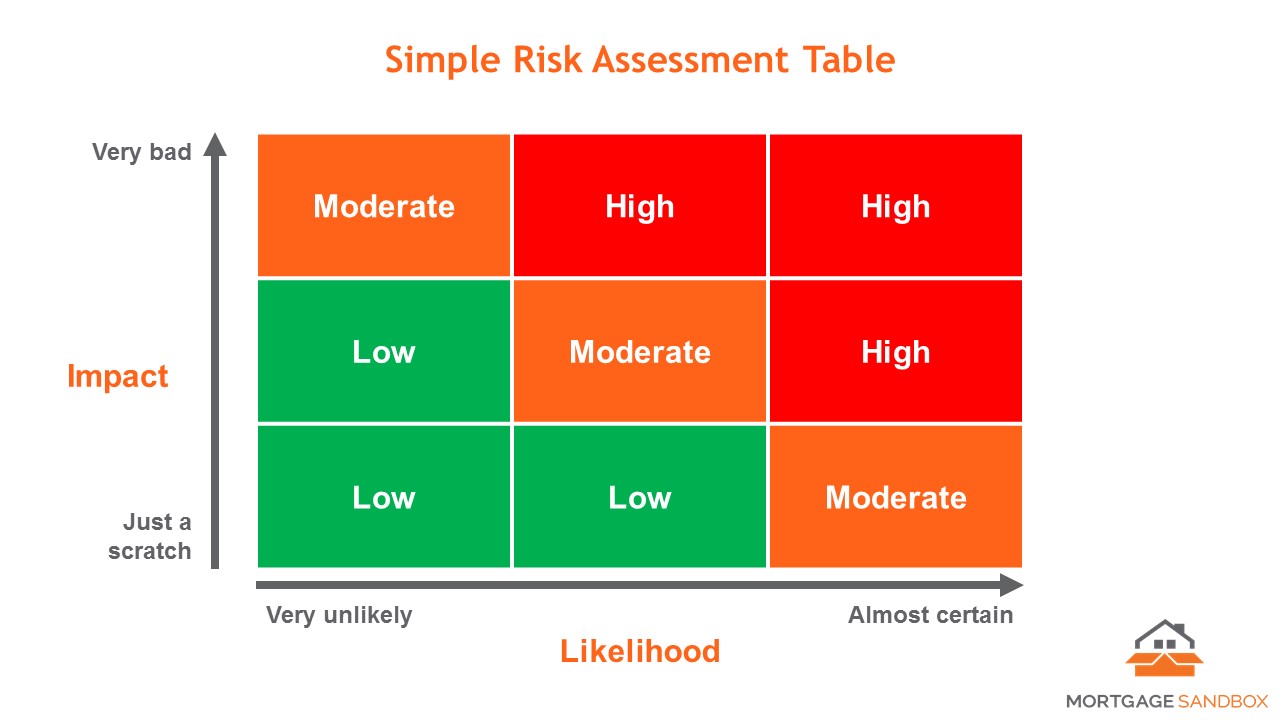

So there is risk in the real estate market. Risk isn't necessarily a bad thing. People drive in rush-hour traffic and handle scissors all the time, and these activities have risk. The way to assess risk, is to determine the likelihood of something happening and estimate how bad it will be. So something that has a high likelihood of happening and could land you in hospital is high risk, but an activity that has a high likelihood of happening but will only ruin the day, is low risk. The table below illustrates how these two factors lead to qualification of a risk as High, Medium, or Low.

RBC and CMHC don't speak specifically to the likelihood of a housing market correction or how much prices might correct, but the fact that there is red on their charts implies something is likely to happen in the next 5 to 10 years and it could be dramatic.

RBC’s Health Check

RBC describes their Health Check as an early warning system. Their report focuses on watching for events that tend to before or during housing downturns and significant home price declines. They don’t believe the system will be a perfect predictor of trouble but they do believe it has a good chance of spotting trouble on the horizon. One concern Mortgage Sandbox has with relying on the RBC report is that by the time this report provides conclusive warnings, it may be too late to course correct.

RBC’s Dashboard

Source: RBC Royal Bank, Housing Health Check (April 2018)

CMHC’s Housing Market Assessment

The objective of CMHC’s assessment is to identify locations in which there are heightened vulnerabilities to housing market instability.

Source: CMHC, Housing Market Assessment- Canada

As you can see, CMHC’s report is similar to the RBC report. In fact, it looks at most of the same factors except that CMHC looks at price acceleration. For CMHC, the fact that condo prices are rising at 20% annually in Toronto and Vancouver is considered an indication of high risk. Here is a mapping of RBC and CMHC’s key risk factors with the risk factors color coded for the Vancouver market.

| CMHC Risk Factors | CMHC Description | RBC Risk Factors |

|---|---|---|

| Overheating | Sales greatly outpace new listings in the market for existing homes. |

|

|

Price Acceleration |

Fast-rising prices often indicate that expectations of house-price appreciation may be excessive. |

No RBC equivalent. |

|

Overvaluation |

House prices are higher than levels supported by personal disposable income, population, interest rates, and other fundamentals. |

|

|

Overbuilding |

Apartment rental vacancy rates and/or inventory of newly built and unsold housing units are higher. |

|

Colour Legend: Red – High Risk Amber – Moderate Risk Green – Low Risk

Summary

A home is a place to live and an investment. From the standpoint of wanting to live in a home you can call your own, this analysis is purely academic. If the home makes you happy then live in it.

From an investment standpoint, if you would choose not to buy a home unless you are confident it will hold its value or appreciate in 5 years, then you should read these two reports and factor the “early warnings signals” into your purchase decision. You may also want to consider whether it is likely the government can keep up with housing demand (see below).

Government policy recommendation

After reading the reports, it is clear that Metro Vancouver home prices are primarily inflated because of a chronic long-term shortage of supply. The best evidence for this is the 0.7% rental vacancy rate which is one of the lowest in Canada.

Yes, there are speculative buyers in the market but they are only successful because they have been speculating that the municipal governments will be unable to bring enough supply to market. The speculators have been right for over a decade while prices doubled. The best solution is to build homes (condo and rental) until Metro Vancouver has a rental vacancy rate of 5%. At that vacancy rate, landlords will offer the best tenants incentives to move into their units and they will be more accommodating of pets. In 30 years, Vancouver's highest vacancy rate was a touch under 3% in 1999.

Like this post? Like us on Facebook for the next one in your feed.