What you need to know about Home Insurance

When you buy a home, the lender requires you to get home insurance but they only require bare bones coverage for the value of the building, but a home is likely your most valuable investment and you need to know that you have enough coverage to protect yourself and not just the bank.

A majority of Canadians believe they have more insurance coverage than they actually have.

A 2017 study found a majority of Canadians living on floodplains think they have overland flood coverage, but the Insurance Bureau of Canada estimates as few as 10% of homeowners actually have that coverage.

This article will cover:

Different types of home insurance

Different coverages

Innovative trends in insurance that provide you extra value and save you money

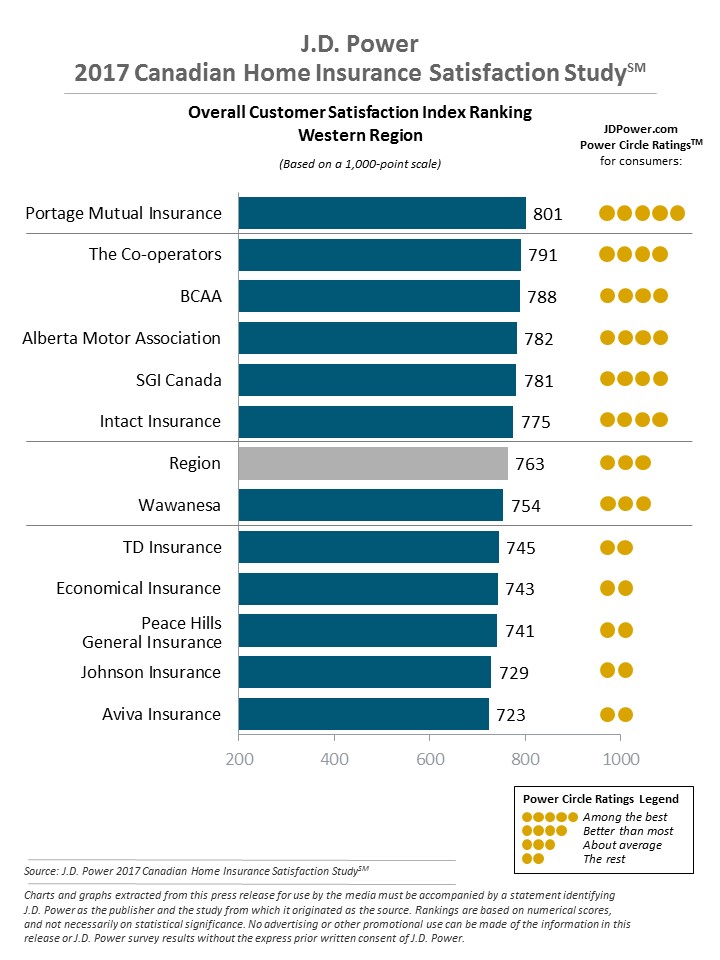

Customer satisfaction ratings of the larger insurers for Western Canada

Types of Insurance

Not all home insurance is made the same. There are four primary types of home insurance that the average home buyer needs to know about:

House Insurance

Condo Insurance

Renters (Tenant) Insurance

Rental (Landlord) Insurance

Different Coverage

The matrix below describes what coverage is typically available for each insurance type. It can be used as a checklist to make sure you have full coverage. Buying the cheapest insurance is a waste of money if it doesn’t provide coverage for the most likely risks.

| Coverage |

House Insurance |

Condo Insurance |

Renters (Tenant) Insurance | Rental (Landlord) Insurance |

|---|---|---|---|---|

| Building (House) | ● | ● | ||

| Building Improvements (Condo) | ● | ● | ||

| Detached Structures (House) |

● | ● | ||

| Condo (Strata) Coverage | ● | ● | ||

| Personal Property | ● | ● | ● | |

| Specialty Property | ● | ● | ● | |

| Additional Living Expenses | ● | ● | ● | |

| Rental Income | Optional | Optional | ||

| Personal & Premises Liability | ● | ● | ● | ● |

| Identity Theft | Optional | Optional | Optional | |

| Fire & Smoke | ● | ● | ● | ● |

| Crime & Vandalism | ● | ● | ● | ● |

| Severe Weather & Flooding | Optional | Optional | Optional | Optional |

| Water Damage & Sewer Backup | Optional | Optional | Optional | Optional |

| Earthquake | Optional | Optional | Optional | Optional |

Before we dive into the details, it’s important to understand that most insurers have tiered coverage. For illustrative purposes we will call them standard, premium, and premium plus. The challenge with this pricing model is, that if you want coverage for jewellery above $10,000 then you may have to buy the premium package but the premium package also covers fur coats, golf clubs, and two bicycles which you don’t need. So essentially you’re paying to insure a lot of things that you don’t have or don't want to insure.

There is only one insurance company, that we know of, that allows “made-for-measure” insurance coverage. More on this later.

Building (House)

The building structure, renovations and improvements you’ve made to your home, like custom cabinets and countertops. Coverage usually will pay for the cost of reconstruction, not the market value. If you live in a condo, then the strata corporation needs to but insurance for the building.

Building Improvements (Condo)

Protects renovations and improvements you’ve made to your home, like custom cabinets and countertops.

Detached Structures (House)

This covers other structures on your property (e.g. garage, storage shed).

Condo (Strata) Coverage

Protection to offset costs assessed to you by your strata corporation for the cost of strata deductibles, or repairs to the building and common property.

Personal Property

Protection for the contents of your home comes in two flavours:

Cash Value: They will pay you the value of the item minus a “charge for aging” to take into account wear and tear. They call this aging charge “depreciation”.

Replacement Cost: This covers the cost of replacing the item with another of similar quality. This is the best type of personal property insurance which is why it costs more.

If you want to be able to recover from an unfortunate event without taking a significant financial hit, you should get coverage for replacement cost. Keep in mind some basic insurance packages may only cover your personal possessions from fire and theft but leave you exposed if something else happens to them.

Specialty Property

Protection for items like jewellery, watches, bikes, computers and cameras. Some items are subject to value limits so you have to pay close attention to these. You don’t want to settle for $500 coverage for bicycles when you have a $1,000 bike. Making a claim on these items, may also require a receipt or an appraisal.

Additional Living Expenses

If an event related to a claim requires you to move out of your home this covers the extra living expenses.

Rental Income

Protects lost rental income lost if all or part of the home is uninhabitable due to damage from an insured loss.

Personal & Premises Liability

Personal liability provides coverage for injury to someone visiting your home, and accidental damage you may cause to someone else’s property anywhere in the world. Keep this in mind if you’re at a store and accidentally break a high value item. Liability insurance doubly important for condo owners and renters in the event there is a fire or water leak in their apartment that causes to neighbouring suites (e.g. kitchen fires, leaking dishwashers). Renters can be liable to their landlord too.

Identity Theft

Identity theft, occurs when someone obtains key information or identification like social insurance or driver's license numbers, in order to impersonate you to cause you financial harm. For example, they may try to steal your savings, use credit cards in your name, or apply for a mortgage on your home.

Fire & Smoke

Coverage for your home and personal belongings in case they are damaged or destroyed in a fire. If you are a renter or live in a condo then this only covers your belongings. The landlord or strata have coverage for the building.

Crime & Vandalism

Coverage for your personal belongings if they are lost, damaged, or stolen. This coverage is in effect even if the item was not inside the home when it was stolen or damaged.

Severe Weather & Flooding

With climate change, weather events are becoming more frequent and severe. This covers damage from wind storms and floods. Keep in mind there are restrictions on flood coverage, particularly if your home is near a river floodplain.

Water Damage & Sewer Backup

If a pipe bursts or your washing machine leaks all over your hardwood floors, this coverage will save your skin.

Earthquake

In the next 50 years, there is a 30% chance of a significant earthquake in British Columbia. Earthquake insurance covers the loss or damage caused to the building and its contents caused by the shaking of the earth.

If the shaking of the earth results in a fire (caused by a broken gas main), only the resulting loss or damage from the fire would likely be covered under an ordinary home insurance policy. In certain circumstances, homeowners who are unable to return home as a result of insurable damage may be entitled to additional living expenses.

The Insurance Bureau of Canada commissioned a study on the impact of an earthquake if you want to learn more.

Two innovative trends in insurance

Customized Insurance

As mentioned earlier, there is only one insurance company, SquareOne, that allows “made-for-measure” insurance coverage. They are based in Vancouver, BC offer insurance across Canada and have recently expanded into the U.S.

To get a customized quote from them, enter your address below:

Value-added Services

Some insurers are trying to differentiate themselves by offering related extra services alongside insurance. In some cases if you buy the extras, they will give you a discount on your insurance policy. It could mean a significant savings over buying these services stand-alone.

Home security – Remote monitoring services

Emergency Support – Automatic gas shut-offs during fire, smoke, or water leakage

Comfort – Remote home control and assistance

Senior citizen support – Special caregivers, meal delivery discounts, and emergency support

Western Canadian Customer Satisfaction

Every year, J.D. Power conducts a survey of large home insurance companies in Canada. The western Canadian results are below and you can see other regions in the full report.

Some key findings from the survey are:

Canadians are generally happier with smaller regional insurance companies but when there are major events like the fires in Ft. McMurray, smaller companies struggle to process the volume of claims.

Most Canadians overestimate their insurance protection.

Like this information? Like us on Facebook.